You can bail out AIG, Greece, or even the United States. You can’t bail out the planet.

There are idiots. Look around.

Harvard’s Larry Summers famously began a draft paper with these words during his early days in academia.1 Markets aren’t rational. Assuming otherwise has been one root cause for the financial and economic mess we are now in, with consequences on a planetary scale. The opposite holds also true: Too many of us acted all too rational in our narrow little worlds.

That goes up and down the financial sector food chain, where everyone it seems has been facing the wrong incentives – from lowly mortgage brokers to credit rating agencies to Chuck Prince, the CEO and chairman of what was once the world’s largest bank. Shortly before collecting a $40 million golden parachute, Prince uttered his famous last words that, “As long as the music is playing, you’ve got to get up and dance.” Emphasis on: “you’ve got to.”

Don’t vilify Prince. Bankers ought to be dancing to the music. There were plenty of crooks and even more who checked their moral compass at the door, but fiduciary responsibility or the profit motive aren’t at fault here. Management is supposed to maximize shareholder value. Investors are supposed to demand the highest returns possible. The regulatory goal may be to slow down the dance a bit, but mainly it is to change the beat. First and foremost, the task is to make sure that everyone faces the full consequences of their actions.

The same goes for environmental problems. No one wants entrepreneurs and businesses to stop dancing. There are certainly some environmentalists who would rather have all business grind to a halt. That cannot be the goal, though. Free markets aren’t the problem. The true problem is that markets aren’t free enough but instead are woefully rigged in favor of pollution.

That rigging comes in two stages. First is that we pretend the atmosphere is a free dumping ground for our pollution. The solution is clear: cap or price carbon. That’s not exactly a novel prescription, and no one will win a Nobel Prize for it. Arthur Pigou, the economist who came up with the idea of pollution taxes died a decade before the first economics Nobel was given out. Still, it works. Tax bads, not goods. Price of polluting goes up, pollution goes down. Simple enough.

But there’s a second, possibly even more fundamental bias. We aren’t just socializing certain losses, we are socializing risks and uncertainties. It’s also where things start to get interesting.

Of Black Swans and 10-foot women

Economists have long been haunted by the so-called “equities premium puzzle.” If you invested $100 in stocks in an average year over the past several decades, you would have $107 a year later – a 7% return. Contrast that with putting money under a mattress. Short-term treasury bills backed by the U.S. government, (still) considered one of the safest investments in the world, pay a rate of return of close to 1%. The difference, the risk premium to make up for your sleepless nights fretting about the ups and downs of the stock market, is 6%. That’s reality.

Economic theory doesn’t seem to agree. It says that under rather reasonable and widely used assumptions for U.S. economic growth (2% per year) and a somewhat opaque but well-established factor depicting the inclination of individuals to accept risk (commonly measured to equal 2 as well), the risk premium should be closer to 0.08%. If $100 invested the safest way imaginable gives you $101 next year, putting those $100 into stocks, says standard economics, should give you $101.08 – not the $107 we see in the real world.

I would be lying if I said that I didn’t consider switching majors when I first heard about this ‘theoretical discrepancy’ in college. Calling this failure of economic theory ‘embarrassing’ is to put it mildly. How can you trust economic tools to solve anything of import? Economists nowadays use their craft to explain everything from cheating sumo wrestlers to primate mating patterns. What we do not seem to have a handle on is how the stock market works.

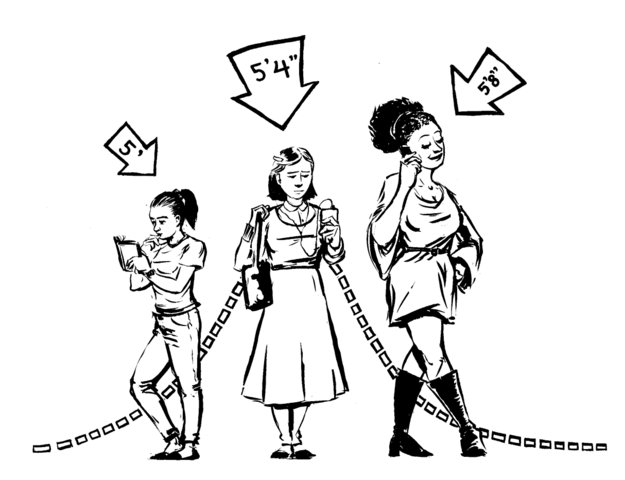

The problem, in short, comes down to Donald Rumsfeld’s “unknown unknowns,” Nassim Nicholas Taleb’s “Black Swans,” Forest Gump’s box of chocolate, or in perhaps the most fitting analogy: 10-foot women.

Source: Gernot Wagner, “But Will the Planet Notice?” (2011). Reprinted with permission from Farrar, Strauss & Giroux.

The average American woman in her twenties is 5 feet 4 inches tall, a bit over 1 meter 60 centimeters.2 Out of one hundred women, ninety will be between 5 and 5 feet 8 inches, the large body of the bell. Really short or really tall women are rare. Only five of the hundred, on average, will be taller than 5 feet 8 inches. Despite their preponderance on the runway, 6-foot women are oddities, at least statistically. Only one woman in recorded medical history was taller than 8 feet. Zeng Jinlian grew to 8 feet and 1.75 inches before she died at the age of seventeen. No one, woman or man, ever grew to twice the average height.

Yet stock markets are driven by 10-foot women. On any given day, the stock market moves a couple percent up or down. Sometimes it even jumps up five percent or down five percent. Large movements are rare, but, unlike living, breathing 10-foot women, they are possible – and they define the final outcome. If we draw stock market movements on a piece of paper, the body of the bell will become smaller. Their tails will be thicker. Some of these tails are outright obese, ‘fat’ in technical statistical jargon.3

Source: Gernot Wagner, “But Will the Planet Notice?” (2011). Reprinted with permission from Farrar, Strauss & Giroux.

Economists have long ignored these phenomena – as it has turned out, at our peril. To get to the bottom of this, we need to bypass economics and go straight to the history books.

Reverend Thomas Bayes first developed these ideas in eighteenth century England, but others have managed to sideline them for the most part ever since. Ordinary statistics assumes that life operates like a card game. There are 52 cards in a deck. The only mystery is which of these cards you will draw next. Bayes figured life was more complicated. He argued that in addition to not knowing which card in the deck would come next, we also didn’t know how many cards the deck had to begin with.

Once we take these “unknown unknowns” seriously, the equity premium puzzle doesn’t just go away, it reverses itself.4 It’s no longer a puzzle why people aren’t buying more stocks, now it’s a question of why, given the occasional 10-foot woman delivering a surprise, they are buying them at all. As a result, the 6% risk premium may actually be too low. Why bother investing, if you always live in fear that your retirement savings are wiped out overnight?

A planetary gamble

It doesn’t take much to shift from the financial to the climate crisis. It’s the same problem and, as it turns out, a similar solution. Protect yourself against 10-foot women. It’s the extreme events that define the outcome.

If nothing were done to limit greenhouse gas emissions into the atmosphere, expected average effects would be bad enough. The current consensus view of the Intergovernmental Panel on Climate Change (IPCC) says that global average temperatures would rise by another 2° to 4° Celsius by the end of the century, on top of the roughly 1°C rise since we humans started to burn up fossil fuels at the beginning of the industrial revolution.

A rise of 2°C to 4°C and the Greenland ice sheet would be in real danger; the West Antarctic ice sheet would begin to melt. The two combined hold enough water to raise global sea levels by 40 feet. Those sheets aren’t melting by the end of the century, but we may be putting processes in place already that will be tough to reverse.

Even though we don’t know exactly when these ice sheets are going to melt, we do know that they will, if we don’t change course. Moreover, that is the average effect, and it does not yet include increased extreme weather events from droughts and famines on one end or more intense hurricanes, typhoons, and monsoons on the other.

It’s impossible to emphasize this enough: not if, when. If we don’t change course, these things will happen, and some already are.

Still with me? If not, I’ll blame it on what psychologists gallantly describe as “cognitive dissonance.”5 It’s akin to shutting out bad news when that news doesn’t correspond with the accepted hypothesis in one’s brain. We are pumping billions of tons of greenhouse gas pollution into the atmosphere each year, and every scientist worth his or her Ph.D. tells us that these gases trap heat. But look, it’s snowing! How can the planet possibly be getting warmer? That click in your brain was your cognitive dissonance kicking in.

There is a lot to this psychological phenomenon, but let’s stick close to the underlying climate science.

There is more bad news: 2 to 4°C is the average in two senses of the word. It’s the expected warming around the globe. Some parts of the planet will warm by less, and might even become cooler. Others will warm more. The poles with their surrounding ice sheets are particularly prone to greater-than-average warming – not a good sign for your beachfront property.

Worse, 2 to 4°C is average in another sense: it’s the range of temperature increases across six different climate scenarios commissioned by the IPCC. Each of these scenarios comes with uncertainties attached to it. The range for the most optimistic scenario with the 2°C average is 1 to 3°C. The range for the most pessimistic scenario with the 4°C average is 2 to 6°C. So really, we are in for “likely” warming somewhere between 1 and 6°C.

With 1°C, things may turn out to be fine after all; 6°C would be catastrophic. Mark Lynas’s Six Degrees painstakingly lists climate impacts degree by degree. He ends with 6°C. Any increase beyond that is an unknown nightmareland, and 6°C itself isn’t all that comforting. Lynas’s first citation in that chapter: Dante’s Inferno and the Sixth Circle of Hell.

“Likely,” of course, is just that. While “unlikely,” there is a 5 percent chance that temperatures will rise by more than 7°C and a 1 percent chance of more than 10°C.6 If you ran this planetary-scale experiment we are currently engaged in on a hundred planets, five planets would be past Dante’s inferno, one would be unrecognizable.

Others go further still. Martin Weitzman, a Harvard economist who was the one to solve the equities premium puzzle by channeling Thomas Bayes, has taken a close look at the numbers. He argues that the IPCC is ignoring 10-foot women. Once we take them seriously, we are looking at a 5 percent chance of warming greater than 10°C and a 1 percent chance of warming greater than 20°C. Now we are beyond anything imaginable. Weitzman’s latest paper focuses on 12°C:

For me, 12°C is iconic because of a recent study, which estimated that global average temperature increases of [around] 11-12°C would cause conditions under which more than half of today’s human population would be living in places where, at least once a year, there would be periods when death from heat stress would likely ensue after about six hours of exposure.7

The authors of the original study add a dry warning:

This likely overestimates what could practically be tolerated: Our limit applies to a person out of the sun, in gale-force winds, doused with water, wearing no clothing, and not working.

That paper is brought to you by the throwaway rumor rag commonly found in every supermarket checkout lane: the Proceedings of the National Academy of Science. Per Weitzman, following his analysis of IPCC data, there is almost a 5 percent chance that we will be on a planet like this. Welcome to the planetary edition of Russian roulette.

We don’t have to wait until this nightmare scenario before we see life-changing effects of an unstable and increasingly warming climate. Some of the earliest studies of global warming and agriculture have concluded that warmer climates may actually be beneficial. But don’t give out that sigh of relief quite yet: beneficial up to a point, and not for long at that. Again, theProceedings of the National Academy of Science:

We find that yields increase with temperature up to 29° C for corn, 30° C for soybeans, and 32° C for cotton but that temperatures above these thresholds are very harmful. … Holding current growing regions fixed, area-weighted average yields are predicted to decrease by 30–46% before the end of the century under the slowest (B1) warming scenario and decrease by 63–82% under the most rapid warming scenario (A1FI) under the Hadley III model.8

Translated into English, entirely without exclamation marks and other emphases added:

Holy cannoli.

Remember my quick reference to “cognitive dissonance,” which allows us to forget all of this at the sight of the first snowfall? I wished I could taste some of that right about now. This is the world we are heading toward.

It comes down to a simple insurance question. There’s a small chance that everything will be fine and that Weitzman, the IPCC, Al Gore, insert-your-climate-change-Cassandra-here are wasting your time. But, sadly, there’s a much better chance that things will not be all that pleasant – the wide body of the bell curve. And on the opposite end of the curve, there’s a small chance that even nude, in the shade, stationary, and whipped by gale-force winds, we won’t make it.

Amazingly, we’ve been here before. One recent headline: “Death toll exceeded 70,000 in Europe during the summer of 2003.”9 Slowly, the lines between supermarket checkout lane publication and scientific journal begin to blur. The tally of dead Europeans, sadly, comes from the latter.

Acting now to prevent an even greater death toll is the prudent thing to do. It’s the rational thing to do. In many ways, it’s the only option we’ve got. The Gods were even kind enough to give us a parallel lesson in our failure to deal with risk during the latest financial crisis end ensuing multi-trillion-dollar morass: don’t be in denial about your fat tails. Put them on a diet. Stop feeding the 10-foot women.

Long-term Capital Management sounds the alarm, again

1998 saw the spectacular implosion of Long-Term Capital Management, which lost billions over the course of a few months and required a government-engineered $3.6 billion bailout to avoid taking down the wider financial system.10 Remember when $3.6 billion was a big number?

More importantly, remember what happened after? Neither do I. That’s because nothing much happened. We all went back to business, and then some. The LTCM bailout might have required emergency meetings of top bankers and some arm-twisting by the New York Fed. The damage was contained, LTCM died, a few were left with scars, and the wild and crazy over-leveraged, under-regulated ride continued and picked up significant speed. We spent the following decade building many more potential LTCMs. Regulators missed the boat completely.

In 1999, Federal Reserve chairman Alan Greenspan warned that large financial institutions created the potential for “unusually large systemic risks” – code for taking down the entire financial system. Greenspan ten years later: “Regrettably, we did little to address the problem.” Regrettable, indeed. $3.6 billion is a rounding error in the latest crisis, where bailout figures hover in the trillions.

As expensive as the financial bailouts have turned out to be, they are at least possible. We might be throwing bad money after good, but it’s all money. Bailing out the planet is in a different league altogether. For starters, bankruptcy – declaring it quits and beginning from scratch – is not an option.

Amazingly, some by now are indeed looking toward engineering a bailout of sorts on a global scale: geoengineering, changing the planet’s thermostat in ways other than addressing the direct cause.11 That’s how far we have come. Some of the same scientists who first warned about global warming twenty or more years ago are now cooking up schemes to hack the planet: mimic volcanoes and pump dust into the upper atmosphere, create artificial clouds and brighten the ones we have, or deliberately change the environment in other ways to counteract the havoc burning fossil fuels has been and still is creating. David Keith, one of the leading geoengineers, calls it “chemotherapy” for the planet. “You are repulsed? Good. No one should like it. It’s a terrible option.” Sadly, if we cannot get our obscene levels of pollution under control soon, it may still be better than letting the globe warm all by itself.

Armed with that knowledge, it’s high time we take the lessons of the financial crisis seriously before we get there. In light of these overwhelming forces pushing us in one direction, it’s all too simple to retreat: minimize your own carbon footprint as much as possible; go off the grid.

That can’t be the answer. Newsflash: recycling won’t solve global warming. If anything, it will be a step backward if it detracts from what is truly necessary. Current technologies don’t allow us to limit global warming pollution.

Even a billion of us decreasing emissions to zero would only register like Lehman Brothers taking a nosedive and the world economy following. Overall trends would still be pointing up. That’s the disheartening news.

The good news, it turns out, is that the overall solution is well known: First, price pollution, ideally through a cap on greenhouse gas emission. The EU is in the lead there, although it, too, ought to strengthen its emissions trading system, include greenhouse gases other than carbon dioxide, expand its reach to more than half of total emissions, and enforce more ambitious goals.

Second, tackle the innovator’s main dilemma. Entrepreneurs don’t consider that their tinkering and inventing will create learned shoulders for others to stand on. We don’t just need to tax the bad, we need to subsidize the good – especially when it comes to learning by doing. We also can’t fall into the trap, though, of only supporting subsidies because it’s politically more convenient than taking the hard step of making polluters pay.12

The failure to learn the lessons of Long-Term Capital Management has cost us dearly. Let’s not repeat the same mistake when it comes to the planet. There’s only one to go around.

The article is adapted from “But Will the Planet Notice?” (2011) by Gernot Wagner, with permission from Farrar, Strauss & Giroux.

Published in the European Financial Review on June 3rd, 2012.

1. Larry Summer’s paper – or at least this phrase – remains unpublished to this day. Several independent sources, however, confirm it. Among them is Justin Fox’s The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street (2009), which independently of the quote is a good summary of the issues.↩

2. The Center for Disease Control’s National Health Statistics Reportcatalogues average height, weight and other vital statistics. Height data here are from a survey conducted in the United States between 2003 and 2006.↩

3. Even fat tails go to zero eventually, but they do so infinitely slower than normal distributions. That’s the technical property that matters here: the ratio of a fat-tailed to a thin-tailed probability is infinity. It’s not that 100 or 1000-foot women are “likely.” Technically, what distinguishes fat tales from the rest is that infinitely tall women are infinitely more likely. Another interpretation of fat tails emphasizes “non-stationary” distributions. At any given time, extreme events are indeed rate. But distributions change. So does the likelihood of extreme events.↩

4. Weitzman, Martin L. 2007. “Subjective Expectations and Asset-Return Puzzles.” American Economic Review, 97(4): 1102–1130.↩

5. Cognitive dissonance ensures that the most comfortable thoughts and feeling prevail. It goes back to Leon Festinger’s A theory of cognitive dissonance (1957). George Akerlof and William Dickens introduced the idea to economists with “The Economic Consequences of Cognitive Dissonance” (1982). I summarize this and other psychological problems with Richard Zeckhauser in “Climate Policy: Hard Problem, Soft Thinking” (Climatic Change, 2011).↩

6. The technical link goes through “climate sensitivity,” a measure that estimates what happens to temperatures as greenhouse gas concentrations double.↩

7. Martin Weitzman’s paper is tentatively titled “GHG targets as insurance against catastrophic climate damages” (First Draft, 4 May 2010). The original source is: Steven Sherwood and Matthew Huber’s “An adaptability limit to climate change due to heat stress” (Proceedings of the National Academy of Sciences, 2010).↩

8. Wolfram Schlenker and Michael Roberts’s “Nonlinear temperature effects indicate severe damages to U.S. crop yields under climate change” (Proceedings of the National Academy of Sciences, 2009). Schlenker, Roberts, and others have published many more papers on this and similar topics: http://www.columbia.edu/~ws2162/.↩

9. J.-M. Robine et al.‘s “Death toll exceeded 70,000 in Europe during the summer of 2003″ (Comptes Rendus Biologies 2008).↩

10. Roger Lowenstein’s When Genius Failed (2000) tells the amazing story of John Meriwether and his partners’ misguided attempts to rely on computer models of risk to explain inherently uncertain situations. Many books have been written about the global financial crisis. Andrew Ross Sorkin’s Too Big to Fail (2009) is the most comprehensive. John Cassidy’s How Markets Fail(2009) provides a sobering look at the role of misguided economic theories. Carmen Reinhart and Kenneth Rogoff’s This Time is Different (2009) takes a long-term view of financial crises over 800 years, disproving the statement in its title: this time may not have been all that different after all. Bethany McLean and Joe Nocera’s All the devils are here: a hidden history of the financial crisis (2010) assigns blame where blame is due. Raghuram Rajan’s Fault Lines: How Hidden Fractures Still Threaten the World Economy (2010) is a must-read for anyone wanting to understand the underlying causes. Robert Pozen’s Too Big to Save? How to fix the U.S. Financial System (2009) is a must-read for any would-be reformer.↩

11. A couple of books discuss geoengineering in eloquent detail: Jeff Goodell’s How to Cool the Planet: Geoengineering and the Audacious Quest to Fix Earth’s Climate (2010); Eli Kintisch’s Hack the Planet: Science’s Best Hope – or Worst Nightmare – for Averting Climate Catastrophe (2010). For the best most recent overview, turn to Michael Specter’s “The Climate Fixers” (New Yorker, May 14, 2012).↩

12. See my essay in Yale Environment 360: “Innovation is Not Enough: Why Polluters Must Pay” (12 March 2012).↩