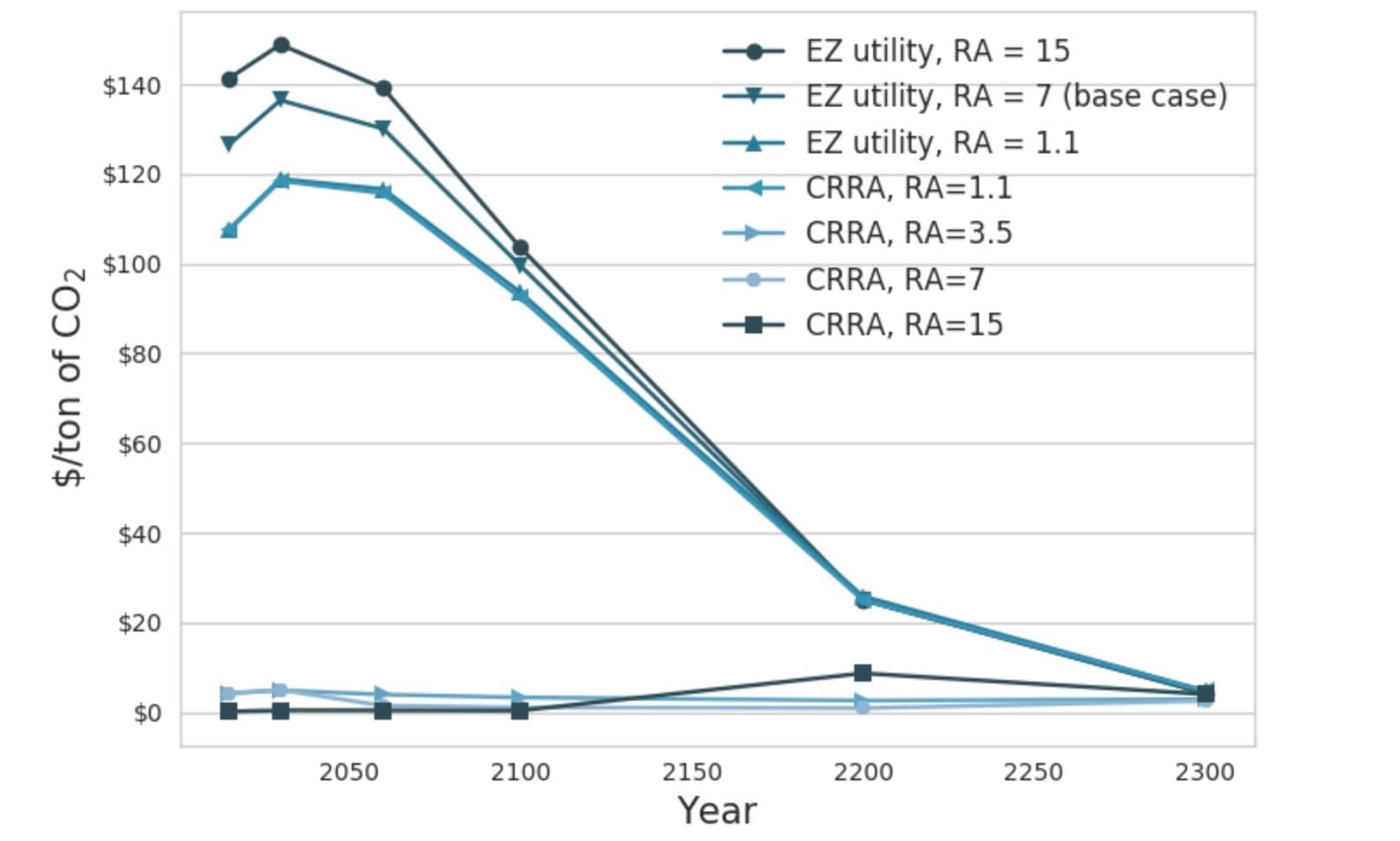

Declining CO₂ price paths

by Kent D. Daniel, Robert B. Litterman, and Gernot Wagner

Significance:

Risk and uncertainty are important in pricing climate damages. Despite a burgeoning literature, attempts to marry insights from asset pricing with climate economics have largely failed to supplement—let alone supplant—decades-old climate–economy models, largely due to their analytic and computational complexity. Here, we introduce a simple, modular framework that identifies core trade-offs, highlights the sensitivity of results to key inputs, and helps pinpoint areas for further work.

Abstract:

Pricing greenhouse-gas (GHG) emissions involves making tradeoffs between consumption today and unknown damages in the (distant) future. While decision making under risk and uncertainty is the forte of financial economics, important insights from pricing financial assets do not typically inform standard climate–economy models. Here, we introduce EZ-Climate, a simple recursive dynamic asset pricing model that allows for a calibration of the carbon dioxide (CO2) price path based on probabilistic assumptions around climate damages. Atmospheric CO2 is the “asset” with a negative expected return. The economic model focuses on society’s willingness to substitute consumption across time and across uncertain states of nature, enabled by an Epstein–Zin (EZ) specification that delinks preferences over risk from intertemporal substitution. In contrast to most modeled CO2 price paths, EZ-Climate suggests a high price today that is expected to decline over time as the “insurance” value of mitigation declines and technological change makes emissions cuts cheaper. Second, higher risk aversion increases both the CO2 price and the risk premium relative to expected damages. Lastly, our model suggests large costs associated with delays in pricing CO2 emissions. In our base case, delaying implementation by 1 y leads to annual consumption losses of over 2%, a cost that roughly increases with the square of time per additional year of delay. The model also makes clear how sensitive results are to key inputs.

climate risk | asset pricing | cost of carbon

Full paper: "Declining CO₂ price paths" (1 October 2019; prior, longer version: NBER Working Paper 22795, 10 October 2018).

The EZ-Climate model code is available via github.com/litterman/EZClimate.

Slides (version: 3 October 2019); Project Syndicate op-ed: "The True Price of Carbon" (28 February 2020)