Carbon Dioxide as a Risky Asset

by Adam Michael Bauer, Cristian Proistosescu, and Gernot Wagner

Abstract:

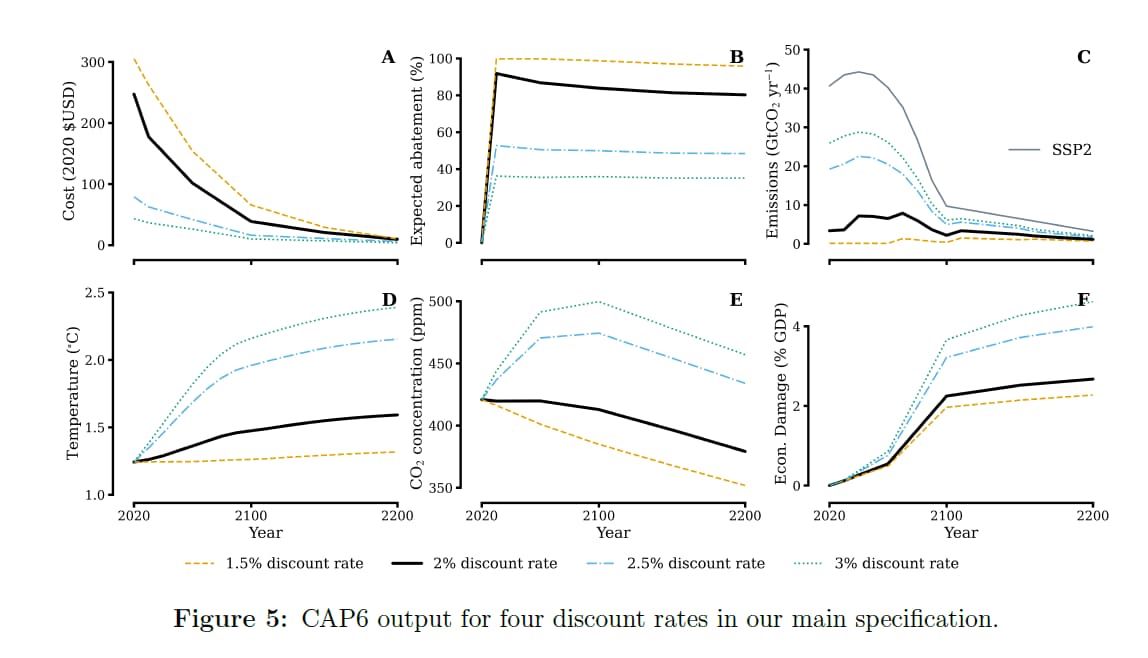

We develop a financial-economic model for carbon pricing with an explicit representation of decision making under risk and uncertainty that is consistent with the Intergovernmental Panel on Climate Change’s sixth assessment report. We show that risk associated with high damages in the long term leads to stringent mitigation of carbon dioxide emissions in the near term, and find that this approach provides economic support for stringent warming targets across a variety of specifications. Our results provide insight into how a systematic incorporation of climate-related risk influences optimal emissions abatement pathways.

JEL Classification: G0, G12, Q51, Q54

Keywords: Climate risk, asset pricing, cost of carbon

Full paper: "Carbon dioxide as a Risky Asset" (Columbia CEEP Working Paper No. 23, CESifo Working Paper No. 10278; this version: 13 March 2024; published version)

Code: github.com/adam-bauer-34/cap6, with some components taken from EZclimate.

Earlier versions:

Columbia CEEP Working Paper No. 23, CESifo Working Paper No. 10278 (20 July 2023).

Media: Jerusalem Post, Yale Climate Connections.

Figure 1A as "Environmental Graphiti" art: