The Cost to Reach Net Zero By 2050 Is Actually a Bargain

A multi-trillion-dollar global investment seems massive. But the closer you look, the smaller the numbers become.

A trillion here, a trillion there: The headline figure in the latest analysis of the costs of achieving net-zero emissions, from McKinsey & Co., is a staggering $9.2 trillion a year, every year, between now and 2050. That comes to a grand total of $275 trillion worth of investments in energy assets and land-use systems ranging from agriculture to forestry.

These numbers are larger than some past estimates have assumed, pointing to the scope of the challenge. Relative to the size of the global economy, they might look larger still—equaling between 6% and almost 9% of global economic output.

But the closer one looks at this particular set of trillions of dollars, the smaller the numbers become, turning the challenge of the clean energy transition into a global opportunity.

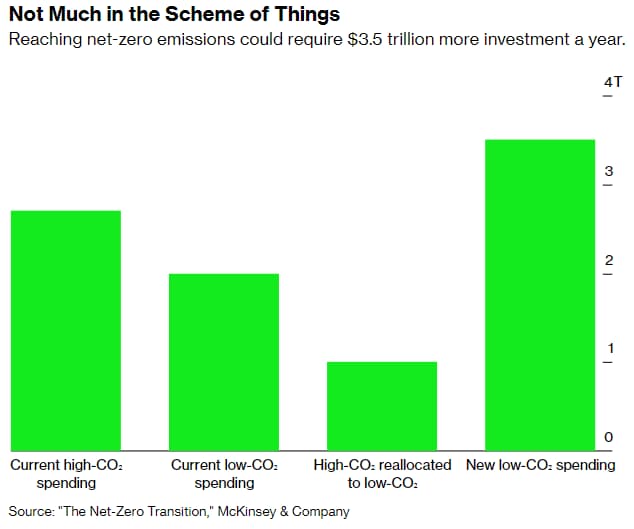

For one, the $9.2 trillion figure includes total annual investments, lumping current and new spending together. The world now spends around $3.7 trillion on what the report calls “high-emissions assets,” such as fossil-fuel extraction, refining, and power generation; cement and steel production; and gasoline-powered vehicles. McKinsey estimates that roughly one of these trillions could be shifted to low-emissions assets like renewable power generation, building electrification, and electric vehicles. That trillion would be on top of $2 trillion the world already spends today on such clean, lean technologies and the supporting infrastructure.

All that puts truly new spending at “only” $3.5 trillion per year—but even that is an overestimate of the additional spending required to get to net-zero emissions by midcentury, and thus to have a chance of limiting global average temperature increases to the vaunted 1.5 degrees Celsius threshold.

To see why, let’s do what any good consultant would call a deep dive into the scenarios behind the McKinsey report.

McKinsey’s estimates are based on climate scenarios developed by the Network for Greening the Financial System, a consortium of over 60 central banks and monetary authorities. The net-zero-by-2050 scenario leading to the additional $3.5 trillion in annual costs cannot stand in isolation. Instead, it must be compared to current policies already on the books. Those policies, too, lead to additional investments down the line, mostly (though not exclusively) on low-carbon assets.

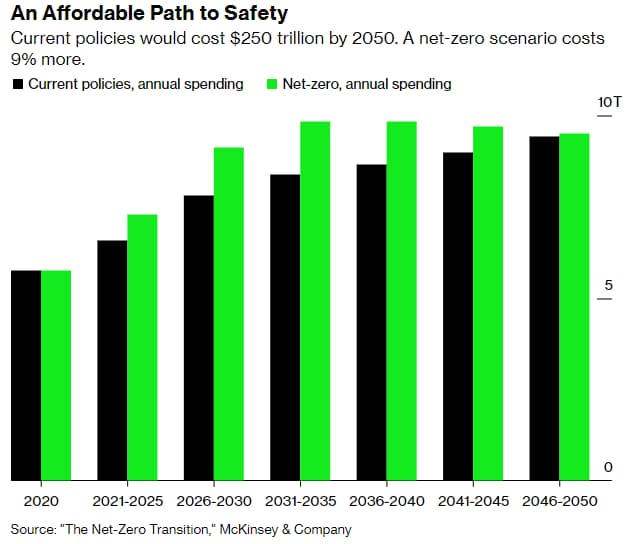

All told, the difference between current policies and net zero by 2050 is only $25 trillion in total spending over the next 30 years, or less than an extra $1 trillion per year on average.

The all-important difference: The net-zero path ramps up spending this decade, reaching its annual peak of around $10 trillion in the 2030s, before falling again. The current policy scenario assumes a much slower ramp-up, reaching its peak by 2050. Essentially, the net-zero path front-loads investments. The reason why is what Saul Griffith, author of Electrify, describes as the shift from fuels to capital: upfront investments to save on fuel costs later.

These fuel costs savings do not yet even include the minor detail of saving the planet by reducing climate risks. Another just-published report, by Aon Plc, found around $330 billion in weather and climate-related economic losses in 2021 alone, the third-costliest year on record after adjusting for inflation. The European Central Bank is looking to a climate stress test that factors in single-year losses of up to 45% in homes exposed to flooding, wildfires and other climate risks. Overall global climate damages easily exceed the cost of action, justifying limiting temperatures to 1.5°C through pure economic reasoning.

Comparing costs now with benefits later is precisely the virtue and the political stumbling block of the low-carbon, high-efficiency transition. Someone does indeed need to spend the money now. Julio Friedmann, a senior research scholar at Columbia University’s Center on Global Energy Policy, argues eloquently that there are three sources of money for the clean energy transition: “ratepayers, taxpayers, and shareholders.” Passing increased energy costs onto consumers implies ratepayers foot the bill. The alternative is to have either governments, ultimately in the form of taxpayers, or shareholders step in to pay. Most every political fight over climate policy is about this jostle over who pays.

The McKinsey report makes it clear that the political headaches are well worth the fight. After all, on net, the transition implies more investment, more economic growth, and also more jobs—to say nothing about a more livable planet and newer, better technologies, from well-insulated homes to better and more efficient modes of transport.

Gernot Wagner writes the Risky Climate column for Bloomberg Green. He teaches at Columbia Business School (on leave from New York University). His latest book is Geoengineering: the Gamble (Polity, 2021). Follow him on Twitter: @GernotWagner. This column was first published by Bloomberg Green on January 28th, 2022, and does not necessarily reflect the opinion of Bloomberg LP and its owners.

Related:

Wagner, Gernot and Bruce Usher. “The Cost to Achieve Net-Zero.” Columbia CaseWorks #220310 (Spring 2022).