Trump Wants U.S. Energy Dominance; Solar Is the Way to Get There

Despite the administration’s push for fossil fuels, solar is faster, cheaper, more stable, and increasingly American-made. Here’s why it’s the smartest path to true energy leadership.

By Gernot Wagner & David Wei

President Donald Trump wants to “unleash” American energy. Doing so means taking advantage of all the United States has to offer, including the cheapest, most obvious, eminently ready, and scalable energy technology: solar power.

Instead, the Trump administration is doubling down on 20th-century energy technologies while sidelining 21st-century ones by expanding oil and gas leasing, propping up uneconomic fossil fuel infrastructure, and attempting to pause federal support for renewables.

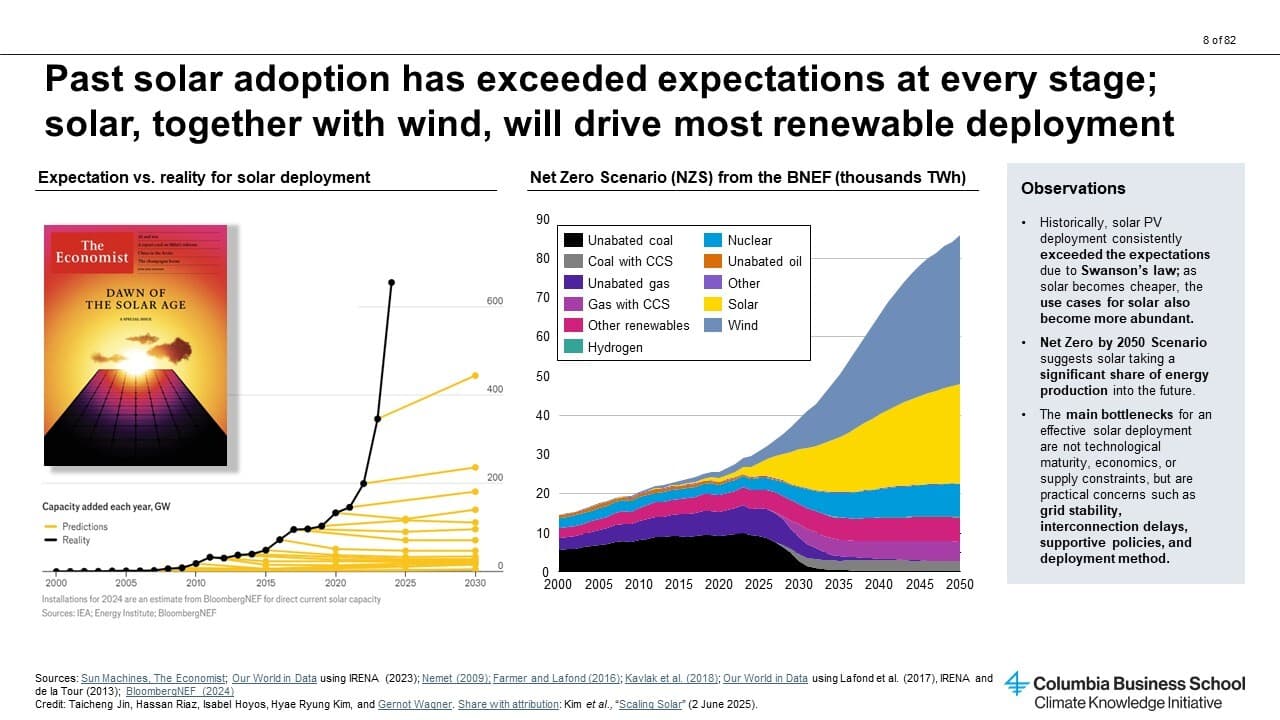

At the root of this energy policy mistake is a misconception of solar power’s advantages. Unlike oil, coal, and gas – commodities, whose prices fluctuate based on geopolitical vagaries and other factors – solar PV is only getting cheaper and better over time. Yet, as solar is still just 6-7% of the country’s generation, continued support is key to ensuring the United States does not fall behind others in the clean-energy race.

Solar Is Cheap, and Getting Cheaper

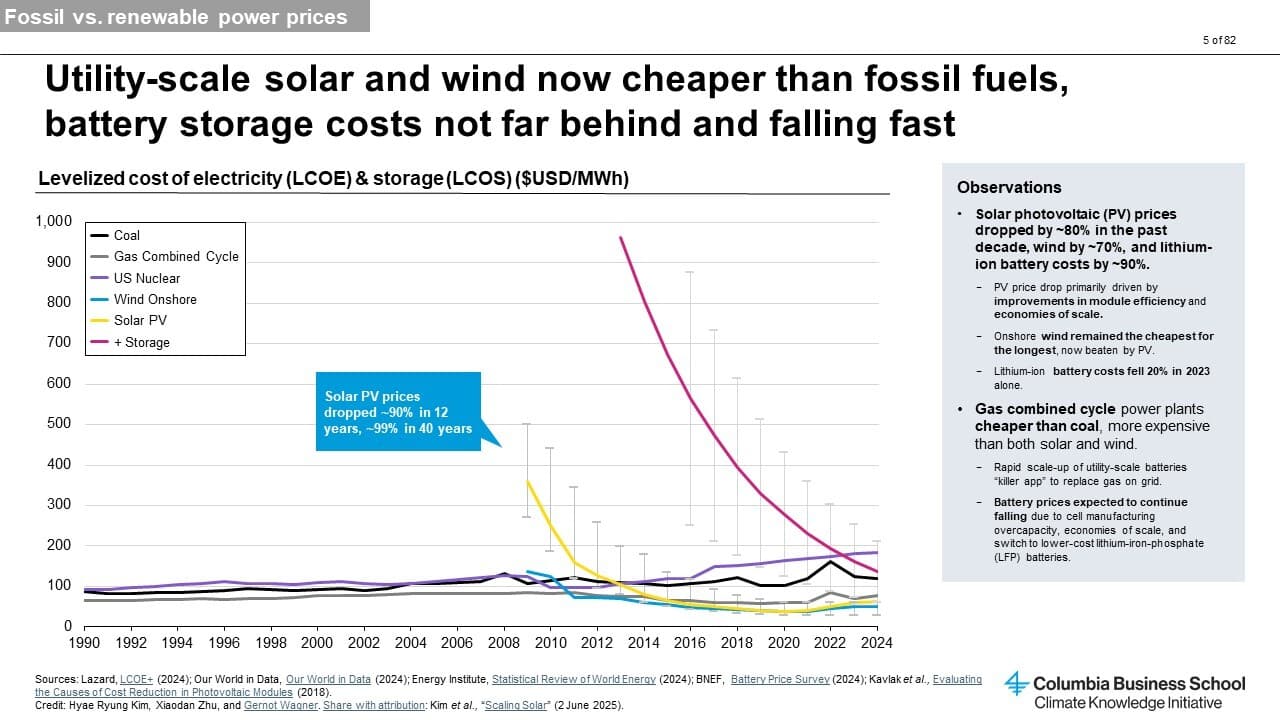

Solar is now the most cost-effective source of unsubsidized energy after years of price declines driven by capital investment. The levelized cost of energy (LCOE) – the all-in cost to build and operate a power asset over its lifetime – is the industry standard for direct comparison across energy sources, and Lazard’s annual reports are the go-to place for consistent numbers. According to Lazard's 2024 report, the LCOE for utility-scale solar has dropped around 90% in the last decade alone, to as little as $29 per MWh, 2.9 cents per kWh, well below gas ($45/MWh) and coal ($69/MWh). All that is before tax credits or other subsidies are factored in.

Utilities and power generators have taken notice, which is why solar has been the incremental winner, making up north of 80% of all generation added last year.

Solar also comes with no variable fuel cost and no price volatility. Once the project is built, the economics are locked in, and stability (especially when paired with storage and other base loads) has proved advantageous for grid operators and investors.

Solar Is Fast

“To get your hands on a gas turbine and to actually get it built across the market, you’re really looking at 2030, or later,” said NextEra CEO John Ketchum in March at an energy conference in Houston. Ketchum is uniquely qualified to make this statement, given NextEra has built the most gas-fired generation over the last two decades. In contrast, he continued, “Renewables are ready to go right now because they’ve been up and running.”

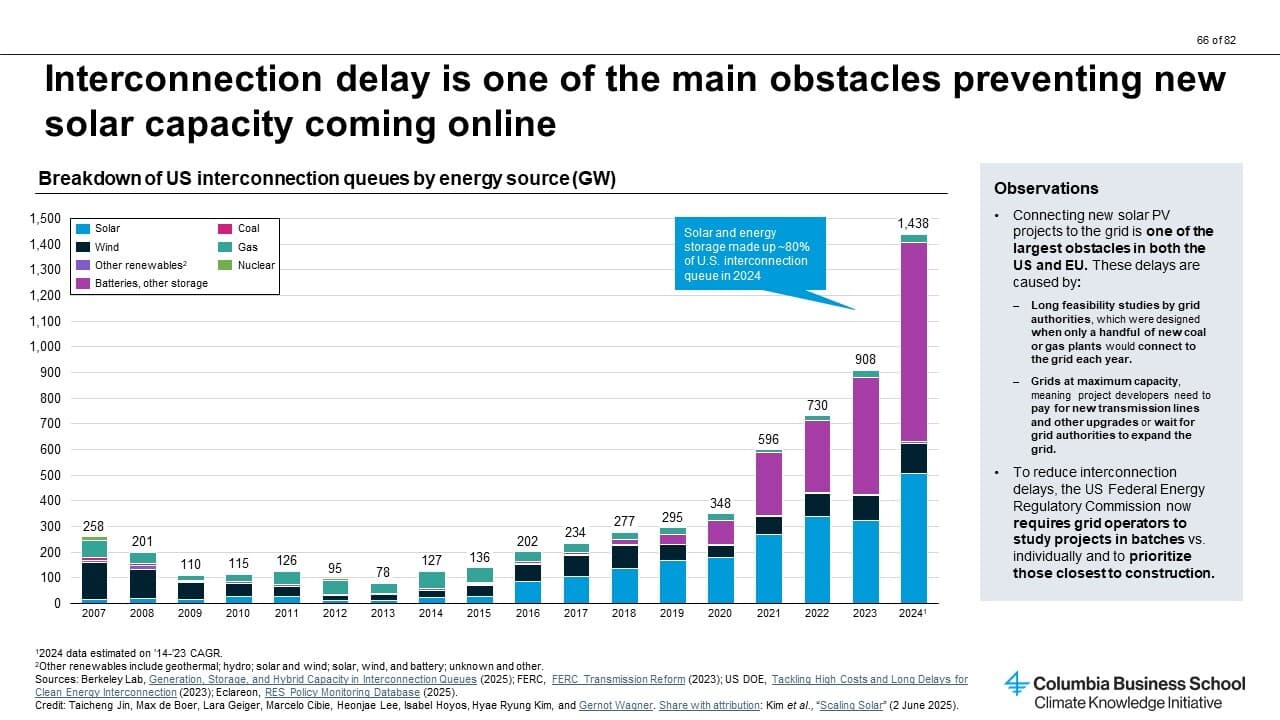

Solar (41%) and battery storage (40%) combined are the supermajority of the active interconnection queues across the country, with natural gas at just 3%. Solar is the only viable near-term option for getting more production to the grid sooner; ramping up natural gas plants would take significantly longer.

Solar Is Increasingly American

True American independence should be rooted in U.S.-generated and installed solar energy – using a source that’s free, unlimited, and immune to global supply shocks.

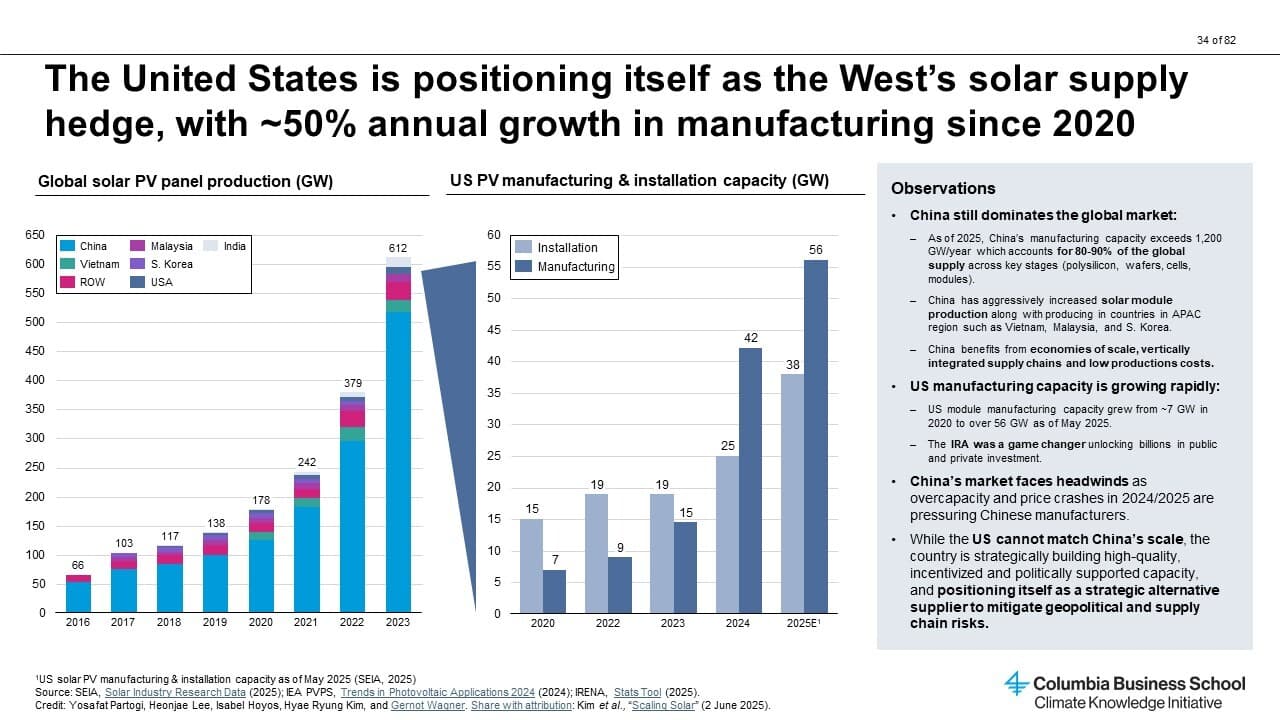

While the collective image of solar power is indelibly linked to cheap Chinese solar panels, and it is true that Chinese companies have dominated key elements of the solar supply chain, the landscape has recently dramatically changed, highlighted by a massive shift in U.S. manufacturing capacity.

In 2020, the United States had around 7 GW in total solar power manufacturing capacity. The Inflation Reduction Act (IRA) boosted incentives for domestic manufacturing, and since its passage, domestic panel production has skyrocketed to over 56 GW (as of May 2025). Those 56 GW are more than 2024’s entire installed volume, though likely fall short of increasing future demand.

All told, the U.S. solar industry employs over 250,000 Americans, including 34,000 manufacturing jobs – a figure expected to double by 2033, if IRA incentives were to remain in place.

A crucial caveat: it’s the panel assembly that has moved to the United States. The further down the supply chain one goes, the greater China’s dominance is. However, there, too, the landscape is changing, in part thanks to the U.S. Uyghur Forced Labor Prevention Act. That means, for example, that Illuminate, Chinese LONGi’s joint venture in Pataskala, Ohio, gets most of its components from outside China.

Policy Certainty

Policy stability is critical for all capital projects, and U.S. energy infrastructure is no different.

The good news is that solar’s success largely doesn’t require anything “new” – just the wherewithal to maintain existing policies. Chevron CEO Mike Wirth noted recently, “Swinging from one extreme to another is not the right policy approach. We have allocated capital that’s out there for decades, and so we really need consistent and durable policy.”

Solar power is not partisan, or at least it shouldn’t be. Eight of the top 10 congressional districts seeing the largest solar investments since the IRA’s passage are Republican-held. These districts have attracted between $721 million and $1.1 billion in actual investments each. That pattern follows broader IRA disbursement trends, with Republican districts benefiting disproportionately from new funding and job creation.

To paraphrase an Economist cover from last June heralding “The Dawn of the Solar Age,” solar power requires sun, sand, and human imagination – and all three are limitless. China and many others are racing into this new energy future. To not take advantage of solar’s potential is to ultimately jeopardize U.S. economic competitiveness.

Gernot Wagner is a climate economist at Columbia Business School. David Wei is VP of Finance and Operations, SolarKal. First published by Columbia Business School on 11 June 2025.